Will Ola’s Lower-Valuation IPO Succeed?

Business Today

Ola Electric Mobility Ltd’s proposed public issue opens on Friday at a scaled-down valuation. The initial public offering (IPO) pricing values India’s largest electric scooter maker at $4 billion, about 25% lower than the valuation based on the last private funding round in September. This valuation is also sharply lower than the $7 billion that news reports had said the company’s founder was initially aiming for but had received investor pushback.

Valuation Comparison

“Cut in IPO valuation to $4 billion eases valuation risk at 6.8 times FY24 sales versus global EV peers at 3-8 times CY23,” according to Incred Research Services. This makes Ola’s valuation closer to the higher end of the global peer range. However, investors need to evaluate the drop in valuation in the context of continuing policy uncertainties in the sector and the relative valuation gap with Hero MotoCorp Ltd.

Policy Uncertainty

For Ola, policy uncertainty is a key worry. Currently, there is a subsidy of up to ₹10,000 for electric two-wheelers as per EMPS 2024 until September. If the subsidy is not extended, there might again be a sudden drop in sales as seen twice in the past, once in June 2023 and then from April onwards. In May 2023, adjustments were made to the incentives provided under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) program, reducing them to ₹10,000 per kilowatt-hour (kWh) and capping them at 15% of an electric two-wheeler’s ex-factory price (previously ₹15,000 per kWh with a cap at 40% of the ex-showroom price).

Sales and Market Position

Ola’s retail sales volume in May 2023 was 28,742 vehicles, and it took six months to regain this level after sales dropped sharply in June 2023. Ola’s sales peaked in March at 53,320 units as FAME II expired and was replaced by the Electric Mobility Promotion Scheme (EMPS) in April. Even after four months, sales are still at 38,887 units for July, much lower than in March 2024.

Market Capitalization and Leadership

Ola’s post-issue valuation works out to a market capitalization (mcap) of ₹33,500 crore at the upper end of the price band of ₹72-76. The company is the undisputed leader in electric two-wheeler sales in India with a market share of 49% based on Q1FY25 retail sales data. Ather Energy, the next pure-play EV competitor, is far behind at 7%. Hero MotoCorp can be viewed as a proxy play on Ather, given its 40% stake in the latter.

Valuation Gap

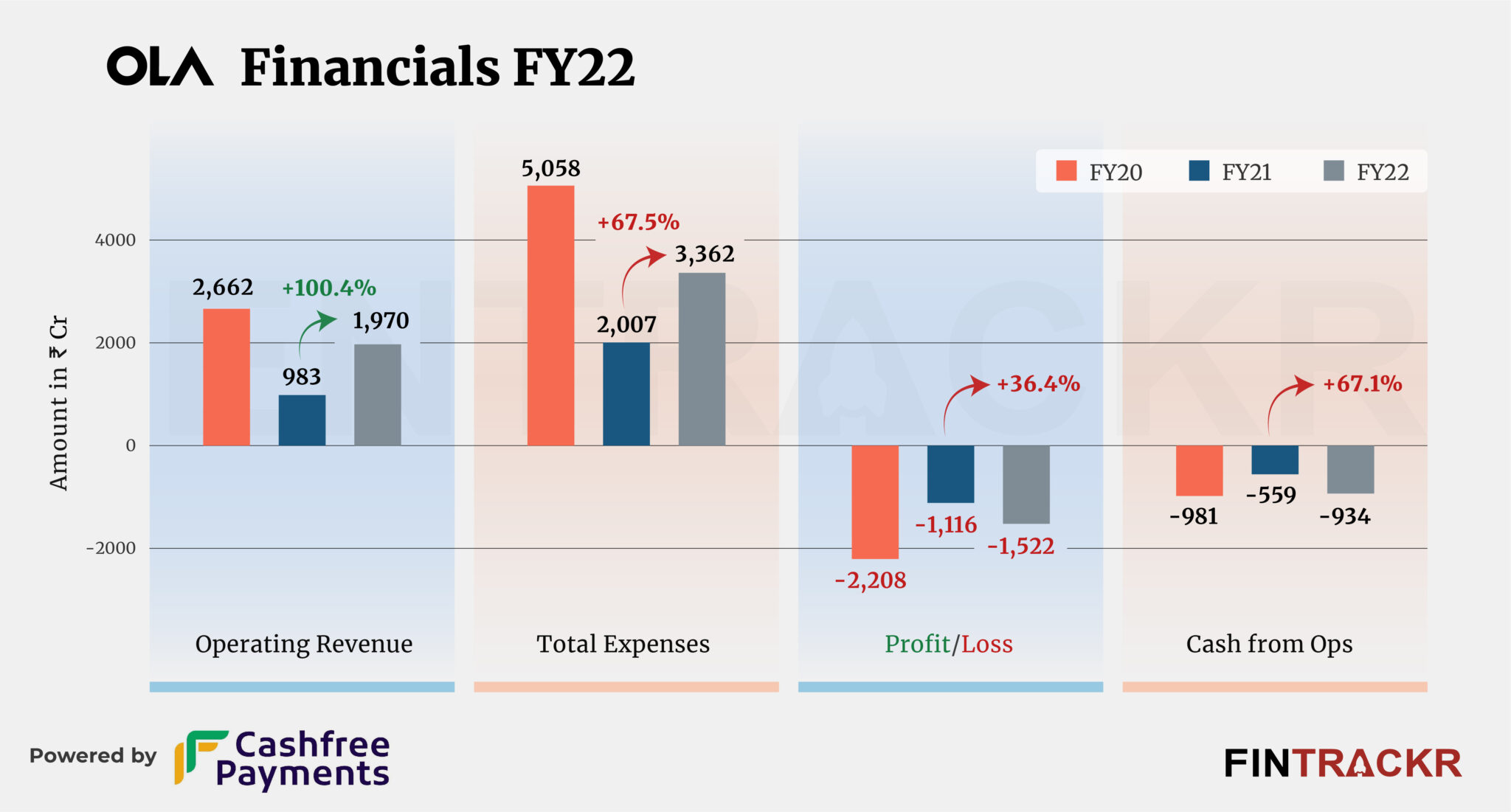

Ola’s mcap works out to 7x FY24 sales from scooters, excluding trading sales, service revenue, and government incentives. The same figure for Hero, excluding spare parts, is 3.5x. Ola’s average selling price for FY24 was ₹1.4 lakh, but the gross margin per vehicle was only ₹10,000 even after adjusting the material cost for the sale of traded goods. The corresponding numbers for Hero are ₹56,000 and ₹20,000, respectively. Ola is making net losses as it is still a new company.

Battery Cell Manufacturing

Some of the huge gap in valuation can be attributed to Ola’s own battery cell manufacturing capacity. Indeed, a part of Tesla’s success is attributed to its battery cell manufacturing. Ola’s prospectus reveals that almost one-third of the production cost of an EV is in the form of a battery. Ola is the first company to commence operations of cell manufacturing in India on a large scale, with 1.4 GWH completed and expected to reach 5 GWH capacity by February.

Conclusion

Notwithstanding the benefit of lower battery cost, investors have to consider that any reduction in policy support could further delay the path to profitability. This would be a tough choice to make.

World Bank Warns India Against Jugaad, Advocates for Capital Deepening

I am Praveen Kumar, a 21-year-old passionate about writing and staying informed. On CNA Times, I bring the latest news and updates, offering readers accurate and insightful information with my expertise and dedication.